estate tax changes proposed 2021

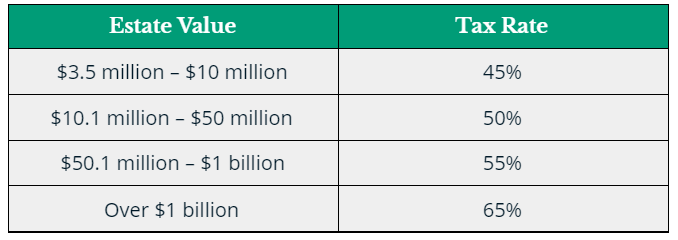

But it wouldnt be a surprise if the estate tax. Thankfully under the current proposal the estate tax remains at a flat rate of 40.

Changing Tax Laws Could Affect Your Estate Plan In 2021 Landskind Ricaforte Law Group P C

Decrease in Exemptions on State Death Taxes.

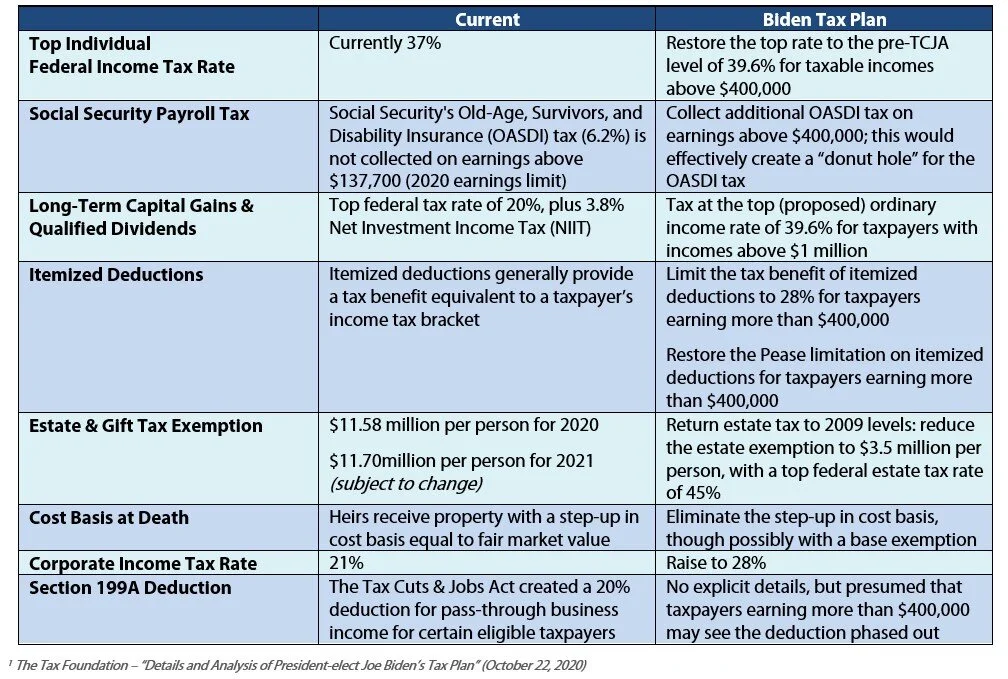

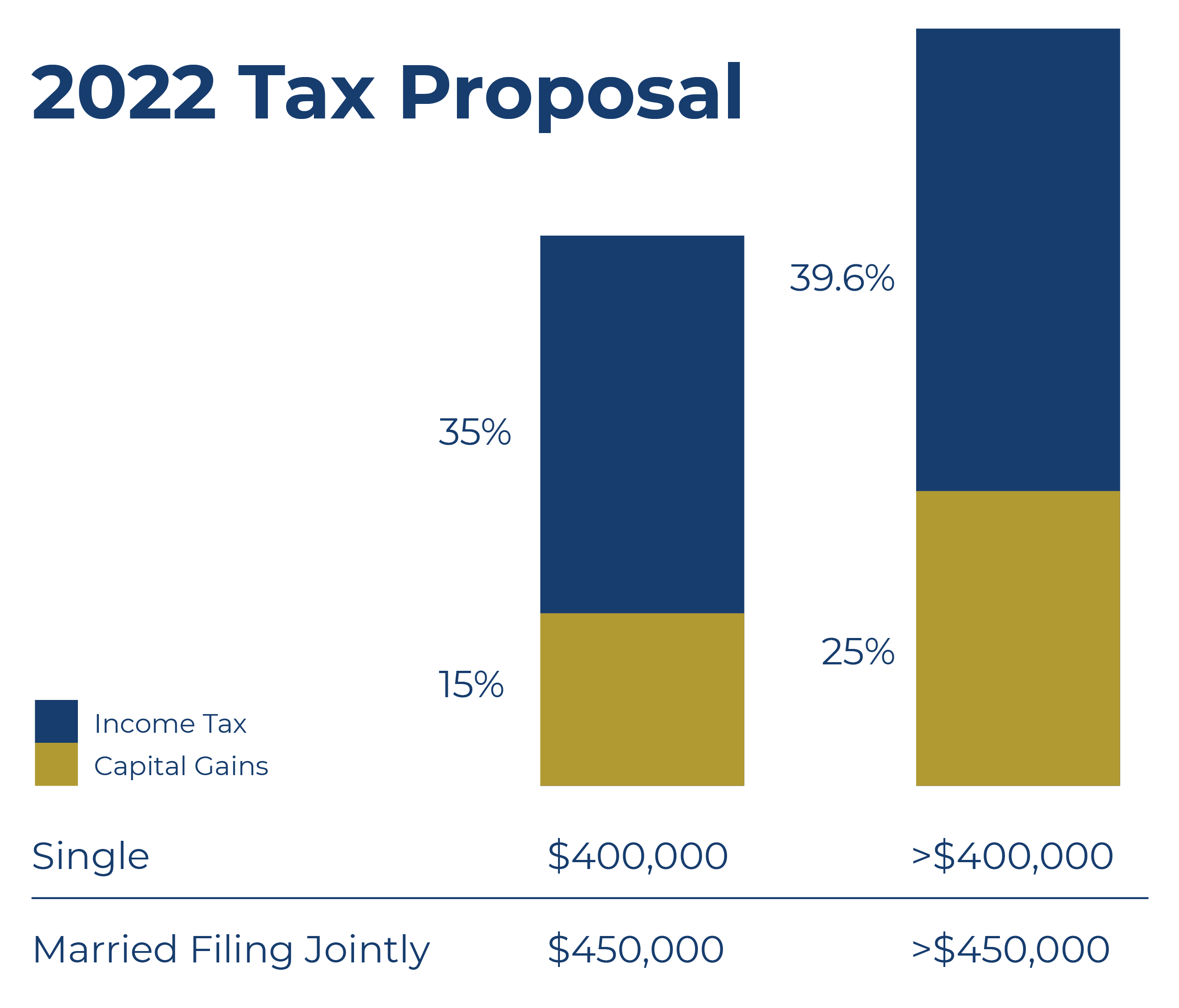

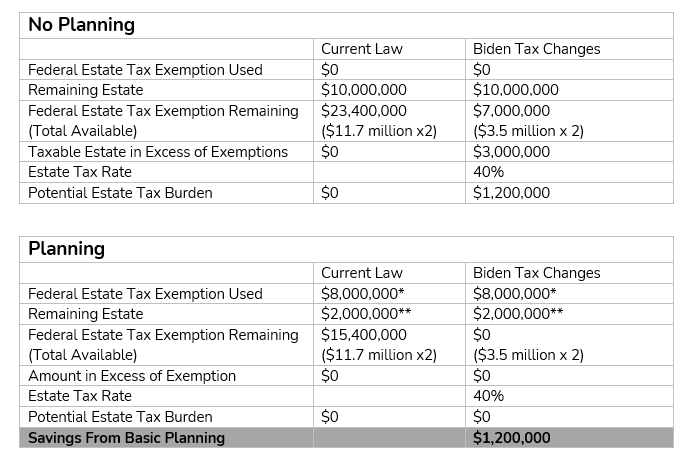

. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. That is only four years away and. Proposals to decrease lifetime gifting allowance to as low as 1000000.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. In this Boston real estate blog post find out what potential real estate tax changes to expect in 2021. House Ways and Means Committee Proposal Lowers Estate Tax Exemption.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. So in a give year we may get 1000 dollars in memberships but they would come in slowly throughout the year. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

One of the tax increases proposed by President Biden during his campaign was a reduction in the estate tax exemption taxing amounts transferred to heirs in excess of. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3.

Decreased from 567 million to 4 million. THE ASSESSING OFFICE IS OPEN MONDAY - FRIDAY BETWEEN 830 AM 430 PM Office Closed Between 1220 PM - 130 PM For Lunch CONTACT INFORMATION. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

Currently we have staggered renewals based on sign up date. 455 Hoes Lane Piscataway NJ 08854 Phone. As of January 1 2021 the death tax exemption in Washington DC.

In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death. The exemption equivalent was significantly raised. Estate and gift tax exemption.

The advice is from an experienced tax lawyer including ways to minimize the. Estate Tax Watch 2021. So if a resident.

As proposed the changes to the taxation of grantor trusts and the.

2021 Estate Planning Based On Changes To Tax Law Martino Law Group

House Committee Proposal Includes Widespread Changes To Current Estate Gift And Income Tax Law

What Will Be In The Biden Tax Plan Riddle Butts Llp

Tax Reform Uncertainty Leaves Taxpayers With Questions Fi3 Advisors

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

Potential Estate Tax Law Changes To Watch In 2021

The Potential For Major Estate Tax Changes During The Biden Administration What You Need To Know Inside Indiana Business

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Biden Administration May Spell Changes To Estate Tax And Stepped Up Basis Rule Pierrolaw

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

American Families Plan Tax Proposal A I Financial Services

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

How Estate Tax Changes Could Affect You And Your Family

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management